sacramento property tax rate

The tax portion of the tax bill remains defaulted and accrues redemption fees and penalties. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate.

Sacramento County Ca Property Tax Search And Records Propertyshark

Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and.

. However because assessed values rise to the purchase price when a home. The median property tax on a. How property values are assessed.

Sacramento CA March 30 2016 The deadline for paying the second installment of your 2015-2016. Beside this how much is property tax in Elk Grove CA. Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the.

Property information and maps are available for review using the Parcel Viewer Application. A valuable alternative data source to the Sacramento County CA Property Assessor. 3636 American River Drive Suite 200 M ap.

For property taxes via mail online or by telephone. For more information view the Parcel Viewer page. While California is known for its high taxes the state.

So for example if your home is deemed to be worth 200000 and your local tax rate is 15 your property taxes would be 3000 annually or 250 each month which is what youll pay into your escrow account more on that in a minute. However as the value of the property rises the assessed value and resulting property taxes may increase more than 2 percent a year up to the annually. Box 508 Sacramento CA 95812-0508 Please ensure that mailed payments have a US.

County Property Taxes. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. In West Sacramento the sales tax rate is 825 percent which includes the state-mandated 725 percent plus four separate ¼ cent voter-approved sales tax measures that fund.

Sacramento Property Tax Rate. For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. Start Your Homeowner Search Today.

With that who pays property taxes at closing while buying a house in Sacramento County. Get free info about property tax appraised values tax exemptions and more. Second Installment due April 11 2016.

Such As Deeds Liens Property Tax More. Click to see full answer. The average effective property tax rate in San Diego County is 073 significantly lower than the national average.

Search Valuable Data On A Property. View the E-Prop-Tax page for more information. The median property tax on a 32420000 house is 239908 in California.

What is the Sacramento County tax rate. Property tax payments are normally sent off beforehand for the entire year. The median property tax on a 32420000 house is 220456 in Sacramento County.

Sales tax in Sacramento is 875. Sacramento County California sales tax rate details The minimum combined 2021 sales tax rate for Sacramento County California is 775. Ad Get In-Depth Property Tax Data In Minutes.

Automated Secured Property Information Telephone Line. Available 24 Hours a day 7 days a. That includes the state county and city sales taxes.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Sacramento County Ca Property Tax Search And Records Propertyshark

Sacramento County Ca Property Tax Search And Records Propertyshark

Sacramento County Ca Property Tax Search And Records Propertyshark

California Sales Tax Guide For Businesses

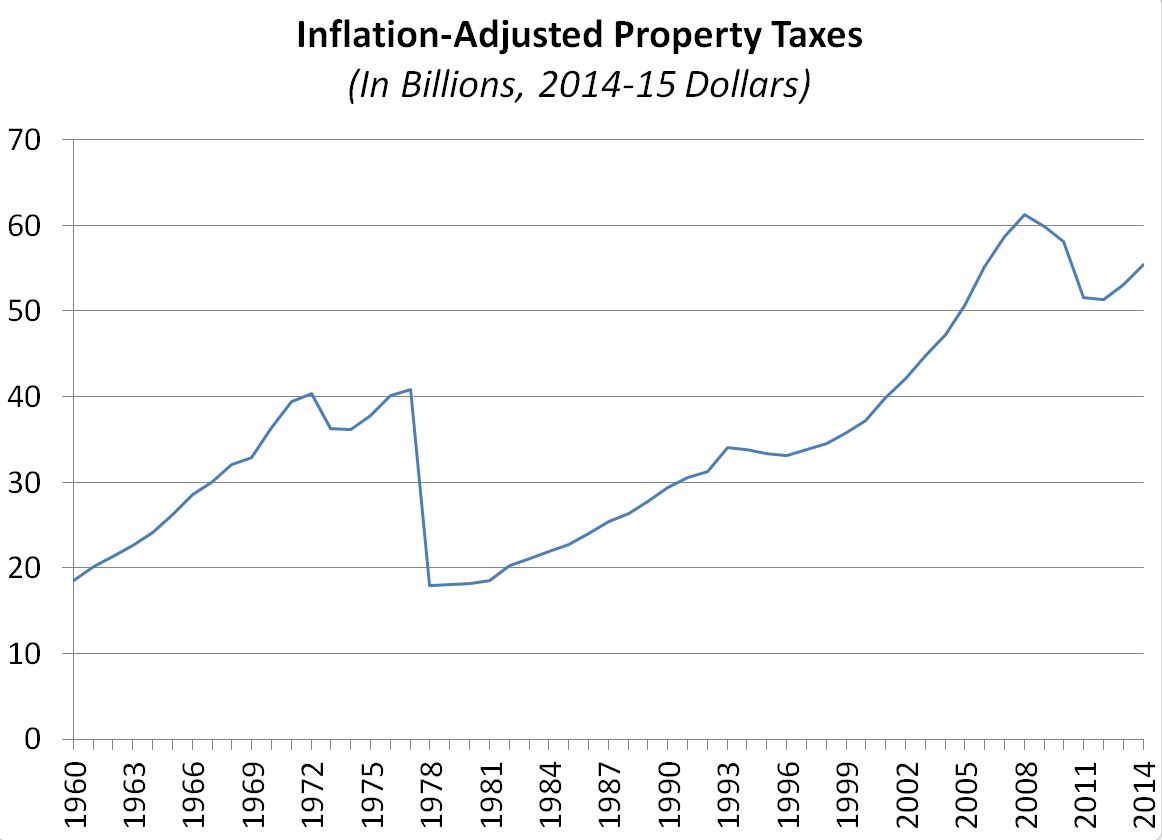

Property Tax Reductions To Diminish As Housing Market Improves

Sacramento County Ca Property Tax Search And Records Propertyshark

Sacramento County Transfer Tax Who Pays What

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Massachusetts Property Taxes These Communities Have The Highest Rates In 2022 Boston Business Journal

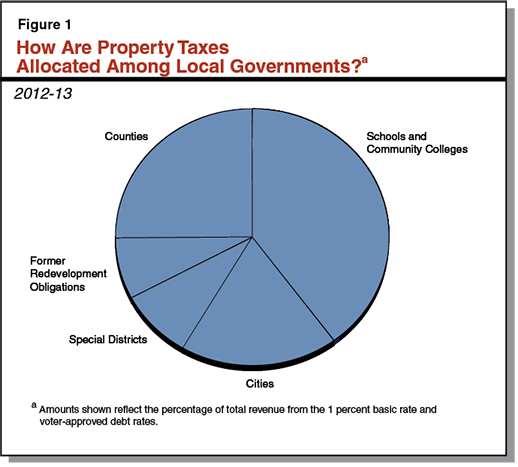

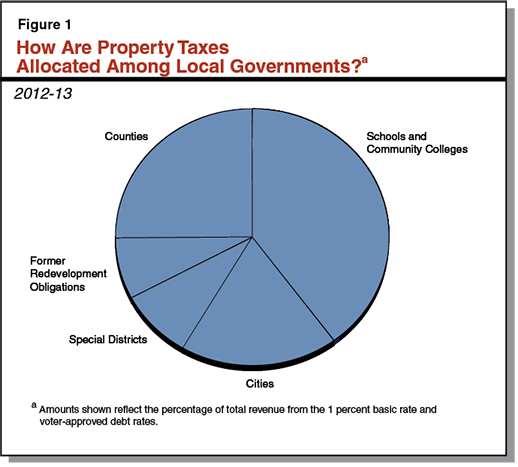

The Property Tax Inheritance Exclusion

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Secured Property Taxes Treasurer Tax Collector

Property Tax California H R Block

Proposition 13 Report More Data On California Property Taxes Econtax Blog

Property Tax Calculator Casaplorer

Sacramento County Sales Tax Rates Calculator

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center