portland or sales tax rate

Though there is no state sales tax Oregon was noted in Kiplingers 2011 10 Tax-Unfriendly States for Retirees due to having one of the. Tax rates last updated in January 2022.

Planning For Oregon S New State Taxes Coldstream Wealth Management

Portland has parts of it located within Clackamas.

. The average cumulative sales tax rate in Portland Oregon is 0. The County sales tax rate is. Business Tax Rates and Other FeesSurcharges Business Tax Rates.

There is no applicable city tax or special tax. This is the total of state county and city sales tax rates. The companys gross sales exceed 100000 or.

Despite the lack of a state sales tax Oregon was named one of Kiplingers Top 10 Tax-Unfriendly States for Retirees in 2011. 2022 Oregon state sales tax. Portland Tourism Improvement District Sp.

Sales tax region name. There are a total of 62 local tax jurisdictions across the state collecting an average local. The current sales tax rate in Oregon OR is 0.

The Portland sales tax rate is. The December 2020 total local sales tax rate was also 8250. The Portland sales tax rate is 925.

Multnomah County Business Income Tax rate. The sales tax in Portland Oregon is currently 75. The December 2020 total local sales tax rate was also 9250.

The Oregon sales tax rate is currently. The current total local sales tax rate in Portland OR is 0000. The County sales tax.

There is one additional tax district that applies to some areas geographically within Portland. The 8 sales tax rate in Portland consists of 65 Arkansas state sales tax and 15 Ashley County sales tax. There are no local taxes beyond the state.

The current total local sales tax rate in Portland TX is 8250. The state sales tax rate in Oregon is 0000. There are ten additional tax districts that apply.

For example under the South Dakota law a company must collect sales tax for online retail sales if. Sales tax region name. Portlands local sales tax jurisdictions are.

Did South Dakota v. The Oregon OR sales tax rate is currently 0. The Indiana sales tax rate is currently.

This rate is made up of a 65 state sales tax and a 10 local sales tax. This includes the rates on the state county city and special levels. City of Portland Business License Tax rate.

The company conducted more than. Exact tax amount may vary for different items. Average Local State Sales Tax.

The minimum combined 2022 sales tax rate for Portland Indiana is. The minimum combined 2022 sales tax rate for Portland Oregon is. The current total local sales tax rate in Portland TN is 9250.

The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. This is the total of state county and city sales tax rates. You can print a 8 sales tax.

Maximum Possible Sales Tax. 4 rows Portland OR Sales Tax Rate The current total local sales tax rate in Portland OR is. What is the sales tax rate in Portland Indiana.

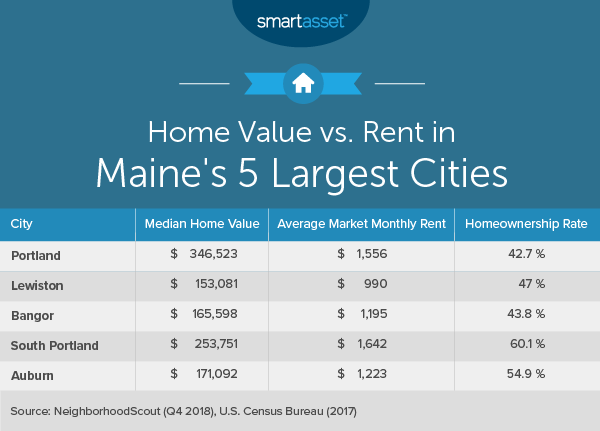

What Is The Cost Of Living In Maine Smartasset

Arkansas Sales And Use Tax Rate Changes July 2019

What Is The Massive Sales Tax Referenced In A Drazan Ad Kgw Com

Do High Local Taxes Really Hurt Economic Growth

What Living In Portland Is Like Is Moving To Portland A Good Idea

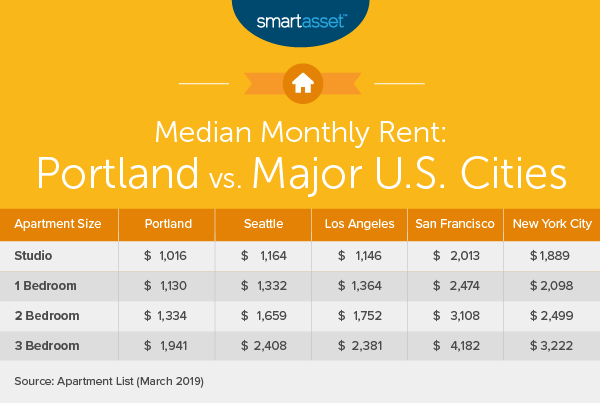

Cost Of Living In Portland Oregon Smartasset

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Oregon S Complicated Property Tax Rates Favor Higher Valued Houses

State Sales Tax Rates 2022 Avalara

How Tax Evasion Fuels Traffic Congestion In Portland City Observatory

Multnomah County Business Income Tax Changes For Ty2020 Business Taxes The City Of Portland Oregon

Study Shows Multnomah County Will Have Nation S Highest Income Taxes For High Income Earners If Preschool Measure Passes

How Low Taxes Lead To High Home Prices In Vancouver Bc Sightline Institute

Study Shows Multnomah County Will Have Nation S Highest Income Taxes For High Income Earners If Preschool Measure Passes

States With No Sales Tax Kiplinger

Mayors Ask Lawmakers To Let Cities And Towns Raise Revenue With Local Sales Taxes Portland Press Herald

How Tax Evasion Fuels Traffic Congestion In Portland City Observatory

Oregon Recreational Marijuana Tax Revenue Surged In 2019 Portland Business Journal